The Hispanic U.S. market represents a significant consumer segment and requires a strategic approach. Here are some quick facts from the AHAA Hispanic Market Guide.

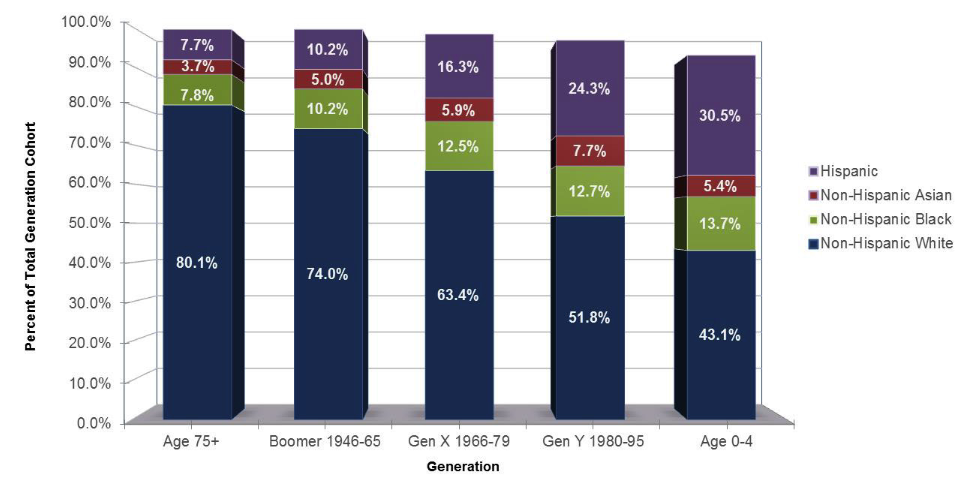

- Minority Majority: 2020 will mark the first time Hispanics 18 and under will be the multicultural majority. Currently 1 in 4 people under the age of 18 are Hispanic, representing the second largest population.

- Disposable Income: Upscale Latinos (earning over $40,000) represent 60% of the total Hispanic households, representing 40% of the segment’s buying power.

- Hispanics are Listening: Hispanics spend over 10.5 hours listening to radio each week, more than Caucasians, African-Americans and Asian-Americans combined.

- The World at Their Fingertips: Hispanics spend 39 minutes using social media on their smartphones and representing 87% of their total usage of 45 minutes.

The 15-year period of 2000 to 215 showed strong (65%) growth of Hispanics, increasingly diversifying the market and representing 57% of the total population growth during that period. This same report predicts a continued increase. By July 1, 2016, the U.S. Hispanic population was 57.7 million. With this population growth also comes a continued growth in wealth and influence. U.S. Census projects the population to increase by 82% by 2058 (from 2016).

With Hispanic Heritage Month on the horizon, I thought it would be a great time to talk about marketing to this attractive segment.

Hispanic buying power has grown from $495 billion in 2000 to $1.4 trillion in 2016 – a 181% increase. That alone represents nearly 10% of total U.S. buying power, making the U.S. Hispanic market larger than the GDP of Mexico and bigger than the economies of more than a dozen countries. This number is expected to approach $2 trillion by 2023.

Businesses and brands willing to benefit from this demographics’ spending power must design ads that align with their values, culture, and purchasing behavior.

Total Market Approach

There was a time when advertising was purely directed at middle America, but as the face of the country began to evolve so did our need to communicate with disparate populations. For years brands have been attempting to reach the multicultural customer with little success. Out of the struggle, the “total market approach” was born.

According to the Cultural Marketing Council, a total market approach “proactively integrates diverse segment considerations” from process to execution in order to enhance value and growth. This approach forces brands to consider audiences in total rather than focusing on the general market and then adjusting for each group of like audiences. Unfortunately, this has left many markets out of consideration because this process is often leaves the nuances of multicultural audiences undiscovered. These markets, though smaller, could be the key to desired growth.

Segments

Culturati Research, along with Hispanic Online Marketing, shared some thoughts on four distinct segments. We’ve taken their segments to create the beginnings of buyer personas.

- Adriana, the Latinista – The Latinista represents $404 billion in buying power. She is very traditional and lives by her Hispanic values. She is the least focused on blending cultures. She speaks mostly Spanish. She’s online a great deal but still consumes broadcast media, although primarily in Spanish. If you want her to respond positively, talk to her in Spanish, and blend traditional Hispanic values in your messaging.

- Cossette, Keeper of the Heritage – Heritage Keepers are open to American values even though they hold on to their Hispanic values. They are bicultural and represent $158 billion in buying power. They are networking and shopping online. As the heaviest users of Spanish radio, they spend twice as much time with Spanish media as English. They respond well to brands that celebrate their culture.

- Hector, the Savvy Blender – Savvy Blenders represent $626 billion in buying power. They have found the way to embrace their roots while still incorporating American values. They research and purchase online. They consume more media in English than Spanish and the heaviest users television and online media, preferring messages in both Spanish and English. They look to align themselves with brands that celebrate the best of both their worlds. They are open to non-traditional Hispanic values.

- Ernesto, the Ameri-Fan – The progressive Ameri-Fans, representing $312 billion in buying power, are culturally American and will not be singled out by brands as Hispanic. They are heavy media consumers, spending the most time with television, radio and internet. By far preferring English, they are the lowest users of Spanish language media. This youthful, technology-dependent group requires more than the one-size-fits-call total market approach.

Language

Communicate genuinely and with respect from copy to visuals and Hispanic consumers will reciprocate with loyalty. It’s not all about translation, but translation is important. Using easily accessible tools is a great first step, but double-checking meaning with a resource that has insight and background could mean the difference between promoting the end of something and someone’s rear end. Additionally, many words can have different meanings from one country to the next. Knowing the origin of the “Hispanic” population can be very important.

According to Simmons Research, Spanish/English preference is split evenly until you examine preference by generations. First generation (or those born outside the United States) tend to favor Spanish by a wide margin. However, second generation Hispanics (those born in the United States – such as me) prefer to speak mostly or all English. Surprisingly only 48% of third-generation Hispanics (born of now American-born parents) prefer English all of the time, with the balance preferring Spanish “some of the time.”

However, advertising in Spanish still matters, even among English-dominant Hispanics. Emotional ties to the Spanish language that carry over to companies that advertise in Spanish, ultimately driving purchase decisions and brand loyalty.

Understanding language preferences will help brands create better marketing campaigns. Body language, malapropisms, and poor syntax could sink an otherwise successful piece of communications. Cautionary tales abound, such as the airline that promoted its new business-class leather seats by inviting passengers to fly “en cuero” (or naked in colloquial Spanish) or New York City Mayor Bill DeBlasio chanting “Hasta la victoria, siempre” – a slogan coined by Che Guevera.

Hispanic have come to the US from over 20 countries – each with their traditions and customs.

Familia y Tradiciones

Typical Hispanic households are large with at least two generations under one roof and will spend slightly more per day than non-Hispanic families. Observing traditions and weaving them into your message appropriately can go a long way to appealing to “la jefa” – a term used by many brands to describe the importance of mom’s stamp of approval.

Tips

- No “hispandering.” It’s a fine line between connecting with the Hispanic community and pandering. Awareness is the key to staying on the right side of that line. Realize the composition of the target Hispanic Community. While most US Hispanics are of Mexican descent, there are regions where the community can be vastly Puerto Rican, Cuban, Honduran, or any number of cultures. These can make a difference in rituals, values and language.

- Look beyond demographics and create personas much like the segmentation exercise shared by Culturati

- Mobile is THE preferred channel.

- Test before your launch. I used to ask my mother to look at any marketing continually we developed for the Hispanic market.

The idea of “Hispanics” is overly broad. Learn about the culture of the Hispanic population you are trying to target and develop your messaging to fit the lifestyle. Invest in a relationship with the Hispanic community.

Recent Comments